Related content

- Who should you vote for in the midterm elections? And why?

- Our choice for Nevada governor: Steve Sisolak

- Our choices on Ballot Questions not related to energy

- Our choices for Congress: Dina Titus, Susie Lee and Steven Horsford

- Our choice for attorney general: Aaron Ford

- On Ballot Question 3, it's a no from us. But barely

- Down the ballot: We share our picks for local and state races

- Our choice for U.S. Senate: Jacky Rosen

- Your comprehensive guide to early voting in Nevada

Question 1 asks: “Shall the Nevada Constitution be amended to: (1) remove existing provisions that require the Legislature to provide certain statutory rights for crime victims; and (2) adopt in their place certain expressly stated constitutional rights that crime victims may assert throughout the criminal or juvenile justice process?” Yes or no?:

At first glance, Marsy’s Law looks like such a responsible, compassionate measure that supporting it seems like the only thing to do. Who’s against rights for crime victims, after all?

But as much as it hurts to say it, some aspects and potential ramifications of the measure are deeply concerning, to the point that we can’t support it.

Marsy’s Law, which has been approved in several other states, would establish 16 constitutional rights for victims in Nevada, some of which are common-sense matters, such as the right to speak at hearings and to be notified about court dates.

Indeed, many of the other elements are perfectly reasonable, but others are worrisome, particularly a right to privacy and to refuse a defendant’s requests for interviews. The latter could hurt a defendant’s ability to defend himself or herself from the state, which undermines a fundamental tenet of our judicial system that guarantees due process for those accused of crimes. That argument has been made successfully in at least one court challenge to Marsy’s Law.

As far as the right to privacy, the element is so vague that it raises questions about how it could be applied. Could it be used to shield the identity of a law enforcement authority claiming self-defense in a shooting, for instance? Were that to happen, it would not be in the community’s best interests.

There are other common-sense means of accomplishing the sensible elements of this matter that won’t be as sweeping.

In addition, Marsy’s Law has been found to be legally flawed elsewhere. The Montana Supreme Court struck it down in November 2017, saying the changes should have been submitted to voters separately rather than as an packaged initiative. And in South Dakota, lawmakers were forced to pass another constitutional amendment to fix problems with the language of that state’s original measure.

Again, many of the elements of Marsy’s Law are worth adopting, and Nevada lawmakers should do just that. But this imperfect ballot measure, amplified by the bludgeon of a constitutional amendment, is not the way to go about ensuring that victims’ rights are protected.

Question 2 asks: “Shall the Sales and Use Tax Act of 1955 be amended to provide an exemption from the taxes imposed by this Act on the gross receipts from the sale and the storage, use or other consumption of feminine hygiene products?” Yes or no?

Yes. With this exemption in place, Nevada would join a number of other states where women would no longer have to pay sales taxes on tampons and sanitary napkins. It’s a fair measure, considering that the state exempts sales taxes on such necessities as food and medical equipment.

Critics have broken into hysterics over the exemption, with some going so far as labeling it sexist—against men. If women don’t have to pay taxes on their menstrual products, why should I have to pay taxes on my jock strap!?!?

Here’s why: Playing sports and wearing a jock strap while doing so are a matter of choice, but that’s not the case for managing menstruation. That’s a matter of health care, not choice.

Opponents also argue that the exemption would hurt the state’s tax revenue. But the impact is estimated at $5 million to $7 million per year, which is a drop in the bucket in the state budget.

Meanwhile, ending the tax would eliminate a form of discrimination against women by acknowledging that feminine hygiene products are not a luxury. It also benefits lower-income women, given that the tax is applied uniformly and therefore disproportionately affects them.

Question 4 asks: “Shall Article 10 of the Nevada Constitution be amended to require the Legislature to provide by law for the exemption of durable medical equipment, oxygen delivery equipment and mobility enhancing equipment prescribed for use by a licensed health care provider from any tax upon the sale, storage, use or consumption of tangible personal property?” Yes or no?

Yes. As explained in Question 2, Nevada already exempts taxes on some necessities. That includes prescription drugs and materials such as splints and bandages. Adding these devices—which also are necessities—is the right move.

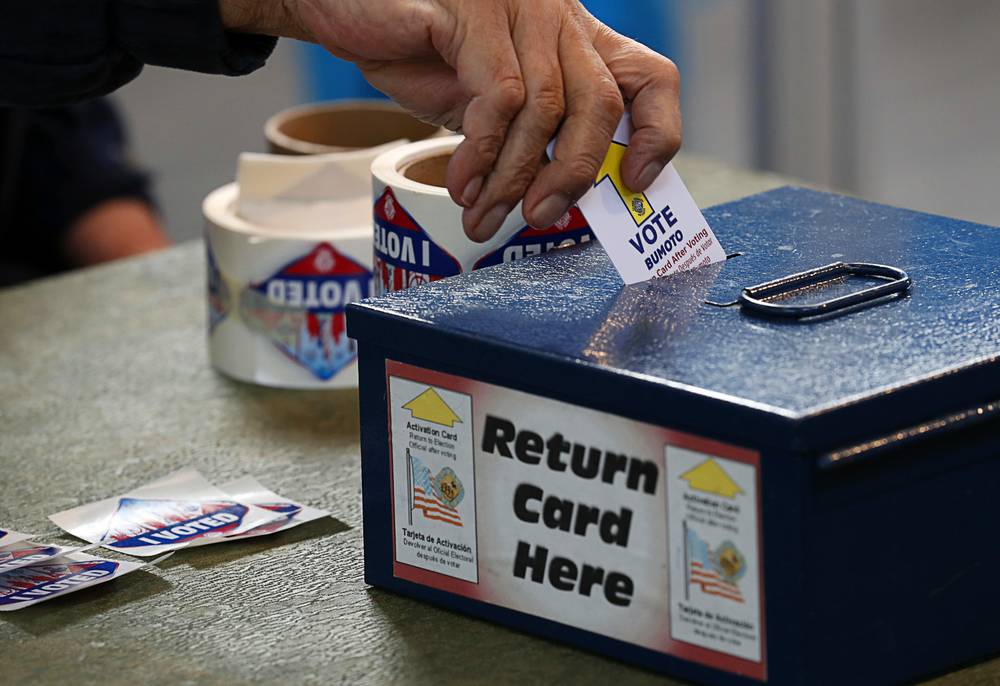

Question 5 asks: “Shall Chapter 293 of the Nevada Revised Statutes be amended to automatically register an eligible person to vote or update the person’s existing voter registration information if the person applies to the Department of Motor Vehicles for the issuance or renewal of or change of address for any type of driver’s license or identification card, unless the person affirmatively declines in writing to apply to register to vote or have his or her voter registrat ion information update?” Yes or no?

Yes. Making it easier for qualified people to participate in our democracy? Say no more. This one’s overdue.