From the patio dining area of Tacos El Gordo on Las Vegas Boulevard, there’s a view of the city’s past five agonizing years, its uncertain present and its possibly exhilarating future.

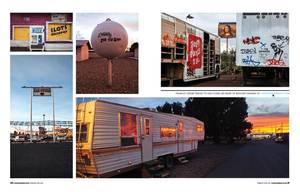

Look, past the roadside signs for the tattoo parlor, smoke shop and foot reflexology joint in the strip mall between Encore and the Riviera. There, stark against the desert sky and the western mountains, are the skeletons of two unfinished buildings on the former Echelon property, one made of concrete, one of steel and both abandoned when the recession took down Las Vegas’ economy.

For most of the last five years, this stretch of the Strip has served as an embodiment of the city’s recessionary decline. When diners at Tacos El Gordo aren’t focused on their plates, they can see desolation in two directions.

Besides the Echelon to the west, the unfinished Fontainebleau can be seen to the north. It blocks a view of the bones of the Sahara, which closed in 2011.

Two major projects and one iconic resort, all of which went bust in recent years—a financial version of a city devastated by war. But even though the view from Tacos El Gordo hasn’t changed much lately, it’s now possible to see it in a different light.

The Echelon property, once home to the Stardust, was purchased this month by the Malaysia-based Genting Group, which announced plans to revive it with a multibillion-dollar resort. Last month, work began to transform the Sahara into an upscale casino, SLS Las Vegas.

Fontainebleau? It’s still as empty and haunting as something out of Chernobyl, but the developments involving Genting and the SLS—along with other works in progress across Las Vegas—have given the city a different feel.

We’re building. We’re evolving. We’re being bold and energetic and maybe even a little brash, like we’re getting into a limo with five people we just met and another whose mug shot we’re pretty sure we saw on TV.

In other words, we’re back to taking chances. Back to being a town on the make. Back to acting like Las Vegas.

The signs are all over the place. In the middle of the Strip, the 550-foot observation wheel that will be the centerpiece of Caesars’ $550 million Linq project is coming together. Farther south, between New York-New York and the Monte Carlo, lies a piece of ground where MGM is planning to build a 20,000-seat arena in partnership with sports and entertainment promoter AEG.

Away from the Strip, we’re building not one but two massive water parks, one in Summerlin and one in Henderson.

Construction projects that stalled during the recession have stirred back to life. After falling off a cliff when the housing bubble burst, home values are rising. Tourism numbers are healthy. Downtown is undergoing a metamorphosis that other communities would kill for. After five years of being shaken down by the recession like a tourist in a border-town jail, we’re fighting again.

By the numbers

- Average private-sector weekly wage in Nevada:

- Fourth quarter 2008: $860

- First quarter 2010: $750

- Third quarter 2012: $790

- Source: Nevada Department of Employment, Training and Rehabilitation

- Number of unemployed individuals in Las Vegas:

- May 2006: 34,078

- July 2010: 144,668

- January 2013: 100,700

- Source: Bureau of Labor Statistics

- Average home sales price in Las Vegas:

- June 2007: $428,817

- January 2012: $143,210

- February 2013: $189,180

- Source: Greater Las Vegas Realtors Association

- Bankruptcies filed in Las Vegas:

- 2007: 9,114

- 2009: 24,525

- 2012: 14,095

- Source: U.S. Bankruptcy Court

“It’s happening all around us,” says Jeremy Aguero, who has been studying the Las Vegas economy for years as principal analyst for the local research firm Applied Analysis. “People are still a little nervous and shell-shocked, but we don’t have to look very far to see other communities that would give their eye teeth to be where we are.”

Maybe you don’t believe. Maybe you say it’s still too early to proclaim our revival. Point taken. No question, the economy remains a work in progress. Unemployment is still brutal—9.7 percent in Nevada as of the last official report. Violence and poverty and other social ills are still running high, as evidenced by a January report showing crime rose 9 percent in 2012 compared to 2011.

The education system went into the recession as one of the worst in the nation and couldn’t get over the hump. Things took another bad turn when the Clark County School District superintendent quit only two years into his contract. He gave just two weeks notice, instead of the 90 days laid out in his contract.

So we have a long way to go.

“Things have really improved, even since the first of the year, but we really went down far in the recession,” says Stephen Brown, director of the Center for Business and Economic Research at UNLV. “If digging back out means getting back to where we were in 2007, I really think it’s going to be 2017 before we’re completely back.”

Even so, Brown and other analysts agree that the worst is behind us. Five years after the economy went kablooey, we’re not only still standing, we’re still Las Vegas. Love us or loathe us, we’re still charging hard for growth and profits and glitz and excess.

We got a taste of our pre-recession past when Genting announced that it would spend up to $7 billion to build a 3,500-room resort on Echelon’s barren dust. It was the first such announcement in years, but to people like economic development executive Tom Skancke, president and CEO of the Las Vegas Global Economic Alliance, it was also a glimpse into the future.

“I think this is the first project to deliver the new mission of our community, which is to attract global businesses to invest in Southern Nevada,” Skancke told our sister-publication Vegas Inc. “It’s going to deliver on us being a global destination for tourism, and starting today we are a global destination for international business investments.”

Along the Strip and Downtown, $2 billion worth of construction projects are under way—and that doesn’t include what Genting and MGM are planning. How many cities would be thrilled with that? With half of that?

As with the Genting project, money from outside the U.S. played a role in the SLS Las Vegas renovation, which was sparked by $415 million in funding under a federal government program that encourages foreign investment in businesses that create jobs.

“It’s a psychological boost, and it affirms real change is happening,” says Robert Lang, co-director of the Brookings Mountain West research institute. “What it demonstrates is that people in the rest of the world with deep pockets may be looking at the Strip and saying, ‘Now’s the time to get in.’”

Even more foreign cash has come from investors who snapped up residential real estate on the cheap in the rubble of the housing market. They and others have helped the median home sales price in Las Vegas grow from $118,000 in January 2012 to $150,000 in February of this year. In addition, more than 500 new homes were sold in January of this year, the most since 2008.

The market is far from healthy, of course, with 59 percent of local homeowners still underwater in their mortgages. That’s the highest rate among the nation’s 30 largest metro areas, and new home sales remain a fraction of their level before the recession, when it was common for 1,500 to 2,500 homes to go up in a month.

But guess what? People are moving here even though Vegas remains above the national average in unemployment, the foreclosure rate and other leftover effects of the recession.

U.S. Census figures released this month showed that the metro area’s population had hit 2 million for the first time. The city had been on pace to hit the milestone years earlier, but the recession led to years of minimal population gains.

“We’re now the sixth-fastest-growing city in the United States,” Aguero says. “People are voting with their feet to move into our community, including a growing number of retirees, and more people are moving here for employment even with an unemployment rate as high as ours.

“We’re not creating construction jobs, but we’re seeing new jobs in other sectors of the economy, and people are moving here for those.”

Aguero says sectors adding jobs include health and education, leisure and hospitality, business and professional services. Meanwhile, the city’s lifeblood trade—travel and tourism—has also picked back up. Vegas had a record number of visitors in 2012, at 39.7 million. Not only has that driven job growth in other sectors, it’s helped prompt a 6 percent increase in retail spending over the past 12 months.

And there are other signs that Vegas is back on its game.

The Smith Center for the Performing Arts celebrated its first anniversary earlier this month, providing a $470 million anchor point for touring Broadway shows, jazz and classical music performances, ballet and other cultural events.

Nevada’s depressing standing in state-by-state rankings of unemployment, housing values and other recession factors have improved, as well. The sliver of good news from the most recent unemployment report was that Nevada no longer had the highest rate in the nation. Rhode Island took over the bottom spot.

“Is our employment growth as high as we’d like it? No, but every month we’re picking off other states,” Aguero says. “We’re starting to see an uptick, and the fact is that our unemployment rate has dropped more than anywhere else in the country over the past 12 months.”

Downtown Las Vegas continues to draw attention from all over, with things happening there at a speed almost unheard of in urban redevelopment. The Weekly’s embedded Downtown reporter, Joe Schoenmann, recently wrote a column about 36 developments that had occurred in the district since 2010, from big-bank movements like the renovation of Zappos’ new headquarters to grass-roots initiatives like bike- and car-share programs.

For comparison, look at the Grand Avenue Project in downtown Los Angeles. That bold venture was once valued at more than $3 billion and was to include a complex of high-rise towers designed by architect Frank Gehry, along with a five-star hotel, an upscale grocery store and luxury condominiums. But those plans were derailed by the recession and have yet to be completely dusted off.

In Las Vegas, some stalled construction projects have been rebooted—like the Shops at Summerlin, which picked up Macy’s as an anchor tenant and is scheduled to open in 2014—but others remain skeletons and ghosts. Spanish View Towers. Vantage Lofts. Mercer. All are unfinished monuments to 2008, and there are more.

The SkyVue project across Las Vegas Boulevard from Mandalay Bay no doubt elicited a “here we go again” feeling among some Las Vegans when construction on the 500-foot observation wheel appeared to stall early this year amid financial troubles. Developers said the issues have been resolved and the project never stopped, but the news gave fuel to those who questioned whether Las Vegas was overreaching with two major observation wheels. (And just last week, a developer proposed yet another observation wheel as part of a larger amusement park.)

It may seem like things are happening too fast, too soon, too big.

Lang believes the city’s prosperity lies in bringing brashness to bear on improving the state’s infrastructure and fostering development in different sectors. To truly get roaring again, he says, Nevadans need to give political and financial support to initiatives to improve highways and the education system. They need to get behind projects like the proposed $800 million, 60,000-seat UNLV Now stadium in order to help the city lock down its lucrative event-related tourism sector.

As much as ever, Lang says, Vegas needs to play it big and loud. “Vegas has never dialed back. If it dials back now, we’re doomed.”

On a recent Sunday, the strip mall between the Encore and Riviera was doing business as usual: vendors offering 24-ounce cans of domestic beer at two for $4.50 and shirts with such slogans as “Every day I’m Gangnam Style—Las Vegas” at an unmarked price. The crowd was light, but it’ll get much busier if and when Genting’s Resorts World and the SLS open.

From Tacos El Gordo, the view would then become one of the city’s resurrection. That image isn’t there yet, but after five dark and mean years, Vegas is stirring awake and throwing a little money around. It’s started moving toward whatever comes next. It’s getting its Vegas back.

“Thumping our chests is the wrong thing to do,” Aguero says. “But is it now time to take a sigh of relief? Yes. We can exhale.”

Tom Gorman also contributed to this report.

Previous Discussion: